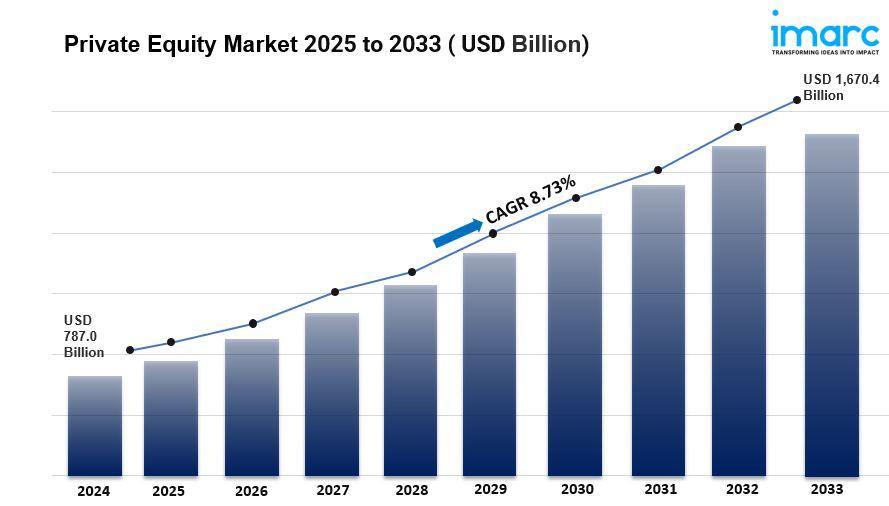

Private Equity Market is Expected to Grow USD 1,670.4 Billion

IMARC Group has recently released a new research study titled “Private Equity Market Report by Fund Type (Buyout, Venture Capital (VCs), Real Estate, Infrastructure, and Others), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

The global private equity market size reached USD 787.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,670.4 Billion by 2033, exhibiting a growth rate (CAGR) of 8.73% during 2025-2033. The increased investor appetite for alternative investments, low-interest rates encouraging leverage, the pursuit of higher returns amidst market volatility, and a favorable regulatory environment fostering investment opportunities are some of the key factors explained in the market research.

Global Private Equity Market Trends:

The private equity market will change significantly. This shift will be due to new investor preferences and market trends. More institutional investors will seek higher returns, increasing funds for sectors like technology, healthcare, and sustainability. This influx of capital will boost competition and spark innovation among firms. They will aim to stand out with unique strategies and offerings. Moreover, the focus on environmental, social, and governance (ESG) criteria will reshape investment approaches. Firms will prioritize sustainable projects to attract socially conscious investors. This trend will likely lead to the creation of ESG-focused funds. Such funds will help firms improve their image and draw in ethical investors. Technological advancements will also impact the market. Firms will adopt new technologies to enhance efficiency and decision-making. Digital tools will streamline deal sourcing, due diligence, and portfolio management, leading to better results. In summary, the 2025 private equity market will blend capital flow, sustainability, and technological innovation. It will play a vital role in global finance and investment. Firms that adapt will succeed and remain influential in the changing economy.

Request to Get the Sample Report: https://www.imarcgroup.com/private-equity-market/requestsample

Factors Affecting the Growth of the Private Equity Industry:

Increased Capital Flow and Fundraising Activity:

The private equity market is set to grow significantly in 2025. This growth will be fueled by more capital and fundraising. Investors like pension funds and endowments are shifting more money into private equity. They aim for better returns in a low-interest environment. Traditional investments, such as bonds, are less appealing now. This trend shows a big shift in investment strategies. Private equity firms are seeing more commitments. This allows them to create larger funds. These funds target sectors like technology, healthcare, and renewable energy. Competition among these firms is also increasing. To stand out, they are innovating. Some are launching specialized funds in niche markets or emerging technologies. This approach attracts investors looking for unique opportunities. The rise of secondaries markets adds more flexibility. Here, investors can buy and sell stakes in existing funds. This boosts participation. With more capital and fundraising, private equity is becoming a key driver of economic growth and innovation.

Focus on ESG and Sustainable Investing:

Climate concerns and social responsibility drive a sea change in private equity. By 2025, ESG criteria will reshape investment strategies. Firms adapt, integrating sustainability to meet new regulations. This shift enhances reputations and attracts fresh capital. Investors now demand transparency, forcing the market to evolve. Private equity's future hinges on embracing these environmental and social imperatives. This has led to the creation of funds focused on ESG criteria, targeting companies with sustainable practices. Moreover, firms are now assessing potential investments not just on financials, but also on ESG performance. This focus on sustainability is changing the investment landscape. Companies with strong ESG profiles are seen as more likely to succeed. Consequently, Sustainable practices now permeate private equity, driving portfolio companies toward positive change. This shift satisfies investors and propels the global economy toward sustainability. By embracing responsible investing, private equity firms have positioned themselves at the forefront of a transformative financial landscape.

Technological Disruption and Digital Transformation:

In 2025, technological and digital advances are reshaping the private equity market. These changes are altering investment strategies and making operations more efficient. Private equity firms are now focusing on tech-driven companies, especially in fintech, healthtech, and e-commerce. These sectors are adopting technologies like AI, machine learning, and blockchain. Firms are using data analytics and predictive modeling to make better investment decisions. Moreover, they are leveraging technology to improve their operations. Digital platforms are making it easier to find deals and conduct due diligence. This process enhances the identification and evaluation of investment opportunities. Also, fundraising is becoming more streamlined. Firms are now connecting with investors online. This shift boosts innovation and decision-making. It also makes the market more competitive. Thus, private equity firms are better positioned to seize new opportunities in a fast-changing economy.

Private Equity Market Report Segmentation:

By Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout holds the majority of the market share because buyout funds focus on acquiring and restructuring underperforming companies, providing opportunities for significant value creation and high returns.

Regional Insights:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

North America's dominance in the market is attributed to its mature financial ecosystem, robust economic growth, and a high concentration of institutional investors and private equity firms.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

Key Companies:

- AHAM Asset Management Berhad

- Allens

- Apollo Global Management, Inc.

- Bain and Co. Inc.

- Bank of America Corp.

- BDO Australia

- Blackstone Inc.

- CVC Capital Partners

- Ernst and Young Global Ltd.

- HSBC Holdings Plc

- Morgan Stanley

- The Carlyle Group

- Warburg Pincus LLC

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Local News

- World News

- Crime

- Politik

- Film

- FootBall

- Food

- Permainan

- Health

- Home

- Literature

- Music

- Networking

- Lain-Lain

- Religion

- Shopping

- Sports

- Opinion

- Tech

- Scam

- Bussines News

- Credit

- Hosting

- Insurance

- Infomation

- Finance

- Entertaiment

- Pendidikan

- Artist

- Trick and hack

- Forex

- Review

- Vps Forex

- Cerita

- agriculture

- assistance