India Insurance Market Size, Share, Demand And Forecast 2025-2033

India Insurance Market Overview

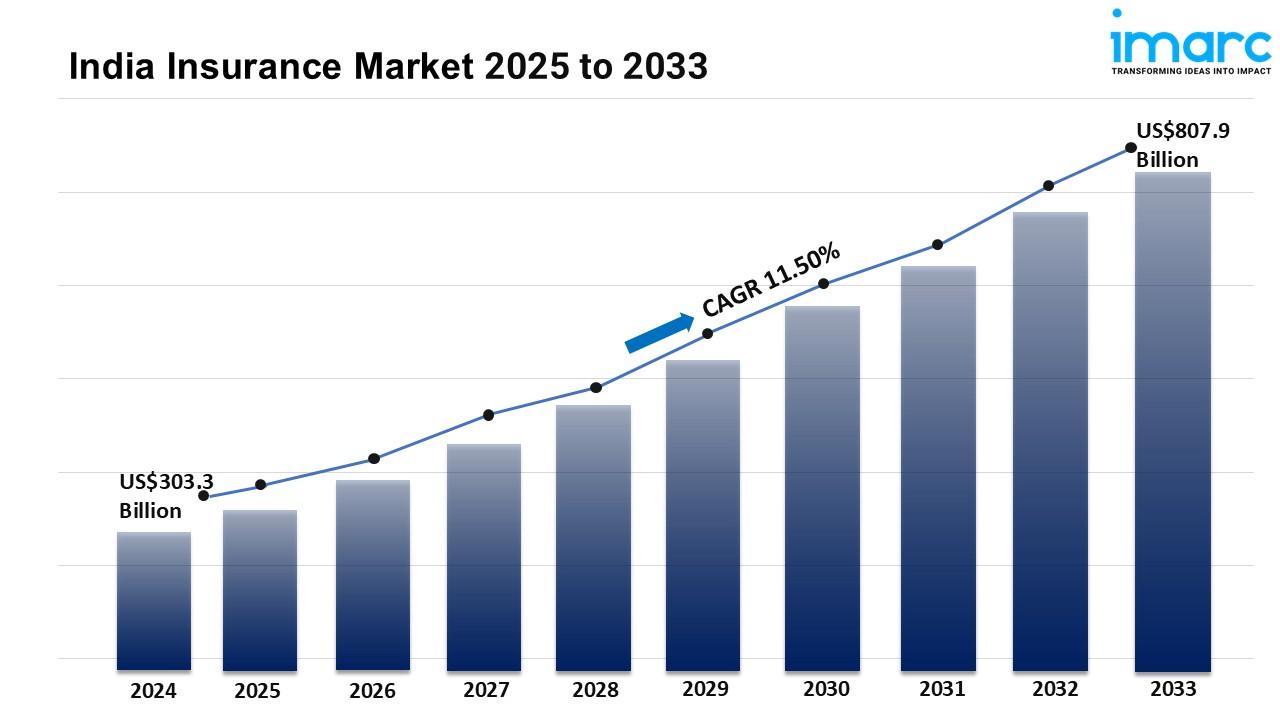

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 303.3 Billion

Market Forecast in 2033: USD 807.9 Billion

Market Growth Rate (2025-2033): 11.50%

The India insurance market size reached USD 303.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 807.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The growing implementation of proactive government initiatives and supportive regulatory frameworks, rising product innovation and diversification, and increasing digital transformation for enhancing customer experience and operational efficiency are some of the factors impelling the growth of the market.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/india-insurance-market/requestsample

India Insurance Market Trends and Drivers:

The India insurance market is experiencing transformative growth, fueled by a confluence of demographic, technological, and regulatory advancements. A rapidly expanding middle class, characterized by rising disposable incomes and heightened financial literacy, is propelling demand for tailored insurance solutions. Urbanization and increased awareness of financial security are encouraging individuals to prioritize risk mitigation, with life, health, and motor insurance emerging as cornerstone products. Simultaneously, digital adoption is revolutionizing accessibility—insurers are leveraging mobile apps, AI-driven platforms, and blockchain technology to simplify policy purchases, claims processing, and customer interactions. Regulatory bodies like the Insurance Regulatory and Development Authority of India (IRDAI) are further accelerating this shift by fostering innovation-friendly policies, including sandbox frameworks for testing emerging technologies. Product diversification is another critical driver, with insurers introducing microinsurance, parametric policies, and subscription-based models to cater to niche segments such as gig workers and small businesses. Partnerships between traditional insurers and insurtech startups are enhancing operational efficiency, enabling hyper-personalized offerings, and expanding reach to previously underserved rural populations. This synergy between consumer demand, digital infrastructure, and regulatory support is creating a robust ecosystem primed for sustained expansion.

Health and life insurance segments are spearheading market momentum, driven by post-pandemic awareness of healthcare costs and long-term financial planning. The proliferation of government-backed health schemes, combined with private-sector innovations in critical illness and wellness-focused policies, is broadening coverage across income tiers. In life insurance, products blending investment and protection benefits are gaining traction, particularly among younger demographics seeking retirement and tax-saving solutions. Insurers are also tapping into rural markets through localized distribution networks and affordable microinsurance products, addressing vulnerabilities related to climate risks and agricultural livelihoods. The industry’s focus on sustainability is manifesting in green insurance products, such as parametric policies for crop failures linked to extreme weather, aligning with national climate resilience goals. Concurrently, partnerships with non-banking financial companies (NBFCs) and e-commerce platforms are streamlining embedded insurance offerings, enabling seamless integration into everyday transactions like vehicle purchases or travel bookings. These strategies are not only deepening market penetration but also fostering trust in insurance as a tool for economic stability.

The convergence of advanced analytics and customer-centric models is redefining competitiveness within the India insurance sector. Insurers are harnessing big data to refine risk assessment, customize premiums, and predict emerging consumer needs with unprecedented accuracy. AI-powered chatbots and virtual assistants are enhancing real-time customer support, while blockchain is improving transparency in claims management and fraud detection. The rise of IoT devices, such as telematics in auto insurance and wearable health monitors, is enabling usage-based pricing, incentivizing safer behaviors, and reducing claim frequencies. Additionally, omnichannel engagement strategies—spanning social media, WhatsApp-based services, and offline advisories—are bridging the urban-rural divide, ensuring consistent brand presence. Insurers are increasingly prioritizing financial literacy initiatives, collaborating with community organizations to demystify insurance concepts and drive adoption in tier-3 cities and villages. As the market evolves, the emphasis on inclusive, tech-driven solutions is positioning India as a global benchmark for insurance innovation, with untapped potential in sectors like cyber insurance and SME-focused group policies. This dynamic interplay of technology, consumer education, and strategic partnerships underscores a future where insurance becomes an integral pillar of India’s economic resilience.

India Insurance Market Industry Segmentation:

Type of Product Insights:

- Life Insurance

- General Insurance

- Health Insurance

- Motor Insurance

- Home Insurance

- Liability Insurance

- Others

Distribution Channel Insights:

- Online

- Offline

End User Insights:

- Corporate

- Individual

Regional Insights:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=25481&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Local News

- World News

- Crime

- Politik

- Film

- FootBall

- Food

- Jogos

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Religion

- Shopping

- Sports

- Opinion

- Tech

- Scam

- Bussines News

- Credit

- Hosting

- Insurance

- Infomation

- Finance

- Entertaiment

- Educação

- Artist

- Trick and hack

- Forex

- Anterior

- Vps Forex

- Cerita

- agriculture

- assistance