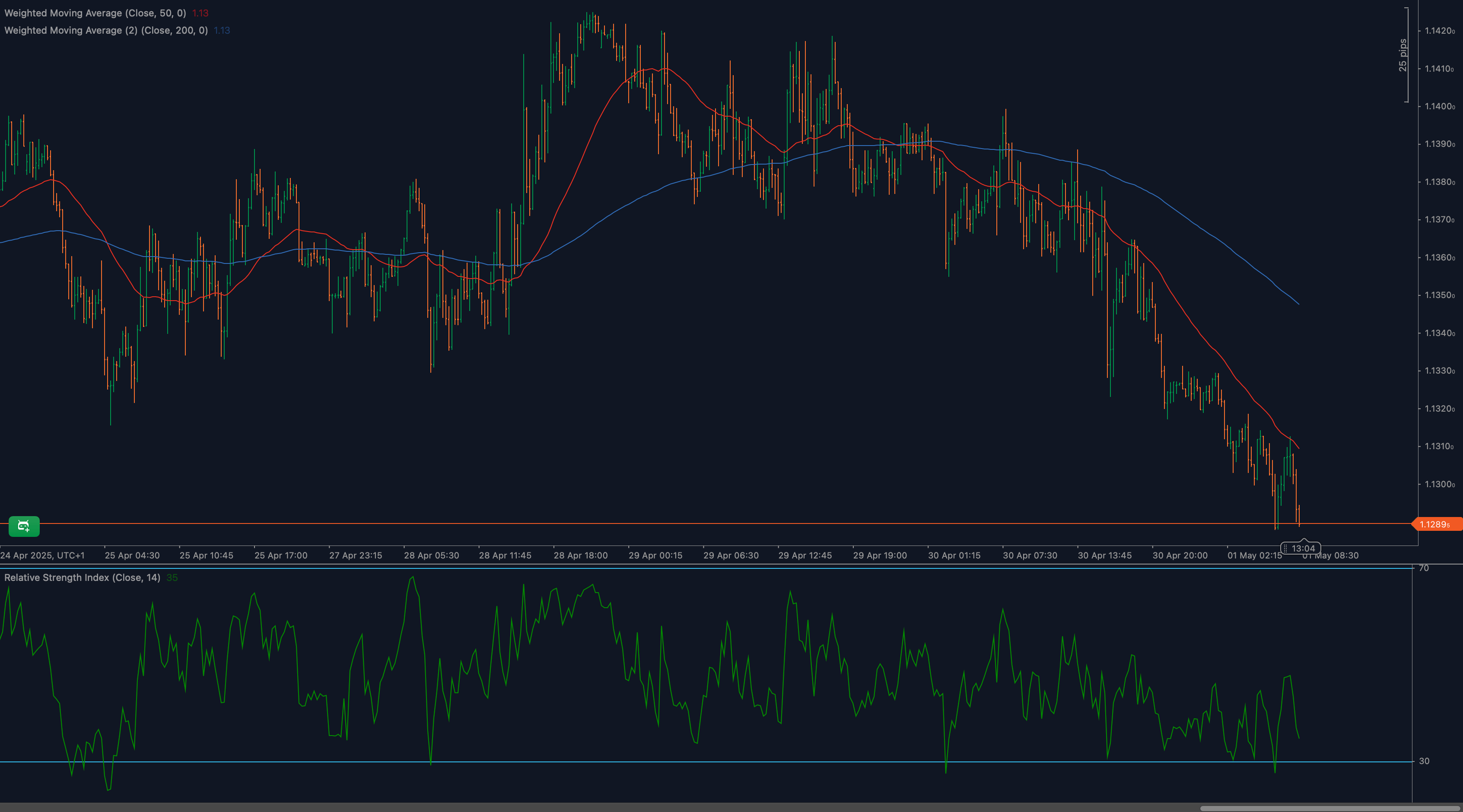

GBP/USD Stalls at 1.3300: Will Fibonacci Resistance Cap the Rally?

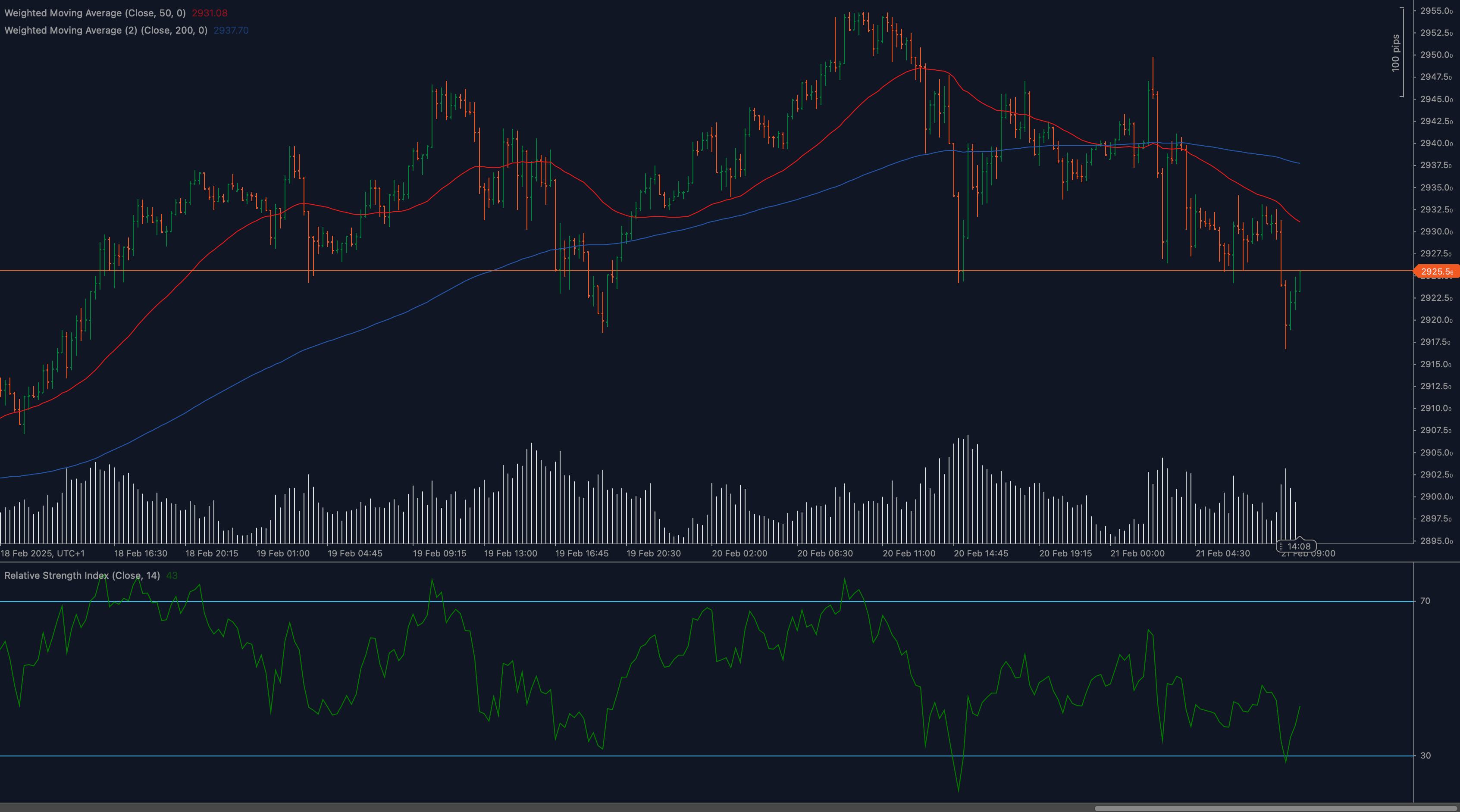

Cable’s recovery from 1.3131 has run into headwinds at the 1.3300–1.3305 zone, where the 23.6% Fibonacci retracement and prior range highs converge. RSI is rolling over, price hesitates under both moving averages, and momentum is fading without confirmation. Unless bulls break 1.3305, deeper pullback toward 1.3250 or even 1.3185 remains likely.

Our full technical analysis explores the Fib roadmap, RSI structure, moving average dynamics and clear trigger zones — all mapped for high-probability setups.

https://vantofx.com/currencies/gbpusd-technical-analysis-struggles-below-1-3300-fib-resistance/

#GBPUSD #ForexAnalysis #TechnicalAnalysis #Fibonacci #RSI #PriceAction #Cable #TradingStrategy #VantoFX

Cable’s recovery from 1.3131 has run into headwinds at the 1.3300–1.3305 zone, where the 23.6% Fibonacci retracement and prior range highs converge. RSI is rolling over, price hesitates under both moving averages, and momentum is fading without confirmation. Unless bulls break 1.3305, deeper pullback toward 1.3250 or even 1.3185 remains likely.

Our full technical analysis explores the Fib roadmap, RSI structure, moving average dynamics and clear trigger zones — all mapped for high-probability setups.

https://vantofx.com/currencies/gbpusd-technical-analysis-struggles-below-1-3300-fib-resistance/

#GBPUSD #ForexAnalysis #TechnicalAnalysis #Fibonacci #RSI #PriceAction #Cable #TradingStrategy #VantoFX

📉 GBP/USD Stalls at 1.3300: Will Fibonacci Resistance Cap the Rally?

Cable’s recovery from 1.3131 has run into headwinds at the 1.3300–1.3305 zone, where the 23.6% Fibonacci retracement and prior range highs converge. RSI is rolling over, price hesitates under both moving averages, and momentum is fading without confirmation. Unless bulls break 1.3305, deeper pullback toward 1.3250 or even 1.3185 remains likely.

💡 Our full technical analysis explores the Fib roadmap, RSI structure, moving average dynamics and clear trigger zones — all mapped for high-probability setups.

👉 https://vantofx.com/currencies/gbpusd-technical-analysis-struggles-below-1-3300-fib-resistance/

#GBPUSD #ForexAnalysis #TechnicalAnalysis #Fibonacci #RSI #PriceAction #Cable #TradingStrategy #VantoFX

0 Commentarios

0 Acciones

224 Views

0 Vista previa